The three giants of American chips—a brief history of TI, ADI, and Intel

The three giants of American chips—a brief history of TI, ADI, and Intel

Transformation and M&A of Computer CPU Giant Intel

Intel, which made its fortune with computer CPUs, is still the largest semiconductor company in the United States (a semiconductor manufacturer that adopts the IDM model). It now has more than 110,000 employees. In 2020, its revenue is as high as 77.87 billion U.S. dollars and net profit is 20.9 billion U.S. dollars. Intel mainly provides microprocessor chips (CPU) to computer manufacturers such as Lenovo, HP and Dell. It also develops and produces motherboard chipsets, communication and network interface chips, memory, graphics chips, FPGAs, embedded processors, and automobiles , The communication and computing related devices required by the Internet of Things and emerging AI applications.

Intel was founded in 1968 by semiconductor pioneers Gordon Moore (for which Moore’s Law is named) and Robert Noyce (one of the earliest IC inventors), with the assistance of Andrew Grove (the author of "Only the Paranoid Can Survive") Under the leadership, it has developed into the world's largest supplier of computer CPU chips. It is said that the company’s English name (Intel) is a combination of the words “integrated” and “electronics”. In addition, “Intel” also means intelligence. It is also a reality to become a spokesperson for the information technology (IT) era. Well deserved.

In the early days, Intel focused on the development of SRAM and DRAM memory chips. In the early 1980s, memory was its main source of revenue. In 1987, Intel was once the 10th largest semiconductor manufacturer in the world. However, the rapid rise of Japanese memory manufacturers and occupying most of the market forced Intel to turn to microprocessor development and production. Its investment in microprocessor design has promoted the rapid development of the computer industry and has also transformed Intel into the largest supplier of PC microprocessors. From 1992 to 2017, Intel has been the world's largest semiconductor chip manufacturer, and AMD, Samsung, Toshiba, TI, ST and TSMC are all hard to beat.

In 2018, due to the strong global demand for memory chips, Samsung's revenue increased significantly, surpassing Intel to become the world's largest semiconductor manufacturer. Due to repeated delays in the 10nm wafer process, Intel was left behind by TSMC and Samsung in the race for the most advanced manufacturing process. At the same time, AMD, which uses the latest TSMC technology, is catching up with Intel in the PC processor market. Although Intel is still the world's largest semiconductor company, revenue and profits are growing steadily under the leadership of CEO Bob Swan, a financial background, but it has been criticized by investors and the industry for its inability to keep up with the rapid development of wafer manufacturing technology.

Intel hired former CTO Pat Gelsinger as CEO in February of this year, and launched the IDM 2.0 strategy to accelerate the development of next-generation wafer manufacturing processes while starting to provide external foundry services. In response to the call of the US government to revitalize the semiconductor manufacturing industry, Intel plans to invest 20 billion US dollars to build a new wafer fab in Arizona, followed by TSMC and Samsung plans to build a new wafer fab in the state.

How is the giant TI made?

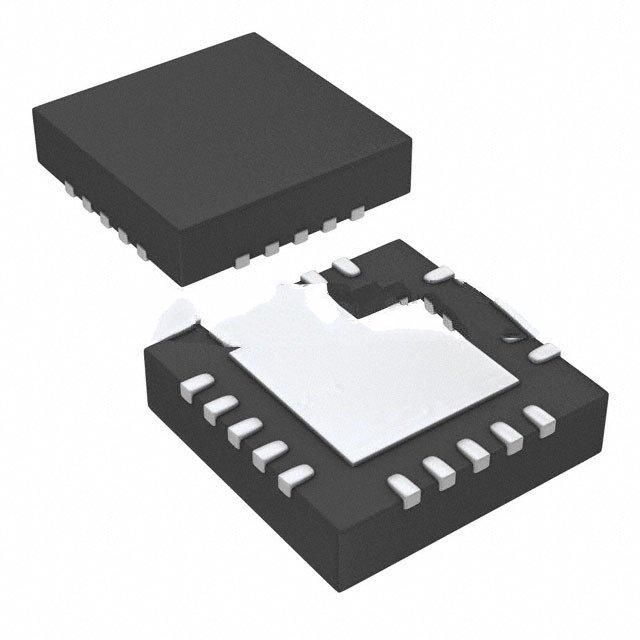

According to Texas Instruments (TI)'s 2020 financial report data, 2020 annual revenue was US$14.461 billion, a year-on-year increase of 0.54%; gross profit was US$9.269 billion, with a gross profit margin of approximately 64%; net profit was US$5.595 billion, a year-on-year increase of 11.52%. In terms of revenue composition, TI has six major business segments. Among them, the industrial market accounted for 37%; automobiles accounted for 20%; personal electronic products accounted for 27%; communications accounted for 8%; enterprise systems accounted for 6%; others accounted for 2%.

In the ranking of the world's top ten analog chip manufacturers released by IC Insights every year, TI has been ranked first for many years, especially in 2020. In 2020, TI’s analog device revenue will be 10.886 billion U.S. dollars, and its profit will reach 4.912 billion U.S. dollars. According to the data compiled by Core Idea, TI's revenue in China will account for up to 55.32% in 2020.

After the second-ranked ADI merged with the seventh-ranked Maxim, the total analog business revenue exceeded 7 billion U.S. dollars, further approaching the leader TI, but it may catch up with or even surpass TI because of the wide application of analog chips and relatively stable growth. It is difficult to have big growth in a short period of time.

Texas Instruments TI was reorganized in 1951 by a seismic measurement equipment and defense electronics company. In 1954, it manufactured the world's first commercial silicon transistor and designed and manufactured the first transistor radio in the same year. In 1958, he invented the integrated circuit in TI's Central Research Laboratory and won the Nobel Prize for it (Intel's Robert Noyce also invented the IC during the same period, but he did not win the prize because he had passed away when he was nominated for the Nobel Prize). TI also invented the handheld calculator in 1967 and introduced the first single-chip microcontroller MCU in 1970.

In 1987, TI invented the Digital Light Processor (DLP), which is the foundation of large-screen projection and cinema DLP Cinema. TI sold its defense business to Raytheon in 1997, allowing TI to focus on digital solutions such as DSP. After acquiring National Semiconductor in 2011, TI has a portfolio of 45,000 analog product categories and customer design tools. In the stock market, TI is usually regarded as the vane of the semiconductor and electronics industries, because its chip products have penetrated almost all electronic products.

Texas Instruments surpassed ST in 2011 to become the analog leader, occupying 15.4% of the entire analog market. In the past 10 years, global semiconductor mergers and acquisitions have been ups and downs, and TI is the only one among the top 10 manufacturers without large mergers and acquisitions, but it has been firmly in the top spot in the analog chip market.

In 2012, TI began to strategically exit the field of mobile phone baseband processors, focusing on analog and embedded processing, and firmly grasping the automotive electronics and industrial electronics markets, achieving revenue of 6.6 billion U.S. dollars and occupying 16.7% of the market. The rate continues to rank first in the analog market.

Texas Instruments TI was one of the first companies to manufacture analog chips on 300mm wafers. Compared with 200mm wafers, manufacturing analog ICs on 300mm wafers can reduce the cost of each die by 40%. In 2017, approximately 50% of TI's analog business revenue came from 300mm wafers. In 2018, TI’s analog business revenue was $10.8 billion, with a market share of 18%, almost twice the revenue of the second-ranked ADI. In 2019, TI analog revenue fell to 10.2 billion U.S. dollars, and its market share increased to 19%. So far, its leading position in the analog semiconductor market is still solid, and no one can shake it.

In July of this year, TI announced a bid of US$900 million to acquire Micron’s 300nm wafer fab in Utah. The 65nm and 45nm process production lines of this factory will further enhance TI’s capacity in analog devices and embedded processor chips.

Analog Devices

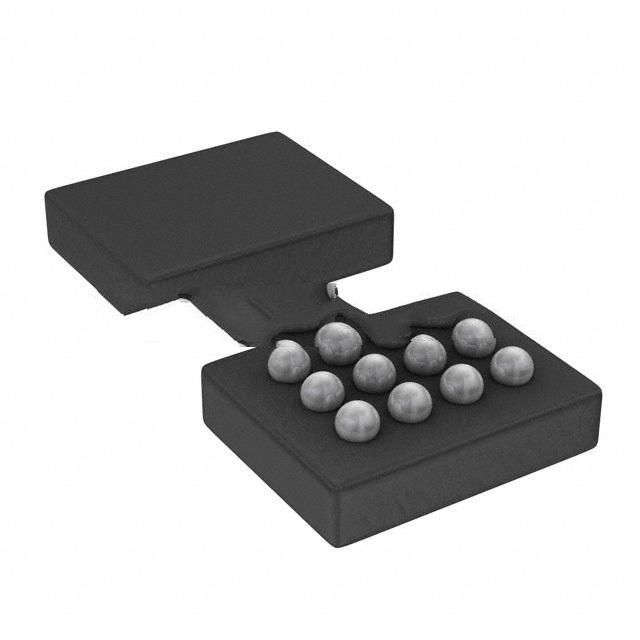

ADI's 2020 fiscal year revenue was 5.794 billion U.S. dollars, and its net profit was 1.22 billion U.S. dollars. Its main technologies and products include: analog and mixed signal (converters, amplifiers, interfaces); power management (voltage regulator, PMIC, monitoring); RF radio frequency (DC-100GHz, microwave, millimeter wave); edge processors and sensors (DSP, MCU, inertia, optics).

The full name of ADI is Analog Devices, Inc. (ADI), which was founded in 1965 by two MIT graduates Ray Stata and Matthew Lorber. The company's first product was the 101 operational amplifier, and in 1973 it was the first to introduce laser trimming chips and the first CMOS digital-to-analog converter. In recent years, under the leadership of CEO Vincent Roche, ADI has made frequent mergers and acquisitions. In 2016, it acquired Linear Technology for US$14.8 billion, and in 2020 it acquired Maxim for US$20 billion, thus becoming an analog giant with sales second only to TI.

ADI is headquartered in Wilmington, Massachusetts, and its regional headquarters are located in Shanghai, China, Munich, Germany, Limerick, Ireland, and Tokyo, Japan. ADI has wafer plants in the United States and Ireland, and its packaging and testing plant is located in the Philippines. ADI's design centers are located in Australia, Canada, China, Egypt, the United Kingdom, Germany, India, Israel, Japan, Scotland, Spain, Taiwan and Turkey.

These three chip giants in the United States have a history of more than 50 years, and have carried out many mergers and acquisitions in the course of their development. After integration and adjustment, and adapting to the development of the market and the times, they have achieved today's brilliance. From the perspective of its headquarters, Intel, located in the heart of Silicon Valley, has grown up simultaneously with Silicon Valley. Nearby are Stanford and the University of California, Berkeley, which continuously provide engineering and technical personnel; Texas Instruments in Dallas, Texas, although not high-tech geographically Although the University of Texas and Austin, the capital of Texas, provide TI with a lot of high-quality engineering and technical personnel (in 2011, it also occupied a place in Silicon Valley after the acquisition of National Semiconductor in 2011); ADI originated from MIT, so naturally, there is no need to worry about top engineering and technical talents. The high-tech zones in the province and the Boston area are also fertile ground for high-tech innovations such as semiconductors.